6+ Superannuation Late Payment

The shortfall amount the contributions not. 15 for all customers.

Late Lodgement Tax Returns Tax Delivery Accounting Solutions Australia

I will pay by hequemoney orderC VISA MasterCard Payee.

. Generally if you pay an employee 450 or more in a calendar month superannuation is required to be paid at the rate of 95 of the employees ordinary time. Submit a SGC form to the ATO for each quarter and each employee for which super was paid. 40150 600 39550 Imogen pays the super guarantee of.

The fine or penalty for late super is called the Superannuation Guarantee Charge and is calculated based on how much you owe. Commonwealth Superannuation Corporation Credit card number - - - Expiry date M M Y Y. When this happens well always make sure you get your payments.

Superannuation interest Form 6. Teddy realises that the super guarantee quarterly due date cannot be extended by law. Our electricity and natural gas delivery.

-- NYSEG and RGE will be suspending late payment charges from Dec. As of 1 July 2021 the super guarantee rate has increased to 10. Massive penalties apply for paying superannuation late Late payment of super can lead to penalties equal to 200 of the amount of superannuation payable.

COMPLETING YOUR SUPERANNUATION GUARANTEE LATE PAYMENT OFFSET ELECTION 5 HOW IS THE LATE PAYMENT OFFSET CALCULATED. Using the late payment offset Imogen subtracts the administration fee from the super guarantee charge as follows. If you pay SG late to your employees super fund you may be able to use the late payment either to offset the SGC or to carry forward as pre-payment of a future contribution for the.

Late super payments if eligibility requirements are met may be used to offset the SGC pay super during the current. Your superannuation payment and all late fees aside from GIC is not deductible. 2 hours agoBINGHAMTON NY.

When super is paid late even by 1 day -you need to prepare and submit a Superannuation Guarantee Charge form SGC within 1 month of the due date. NZ Super and Veterans Pension payment dates for 2022 Sometimes your regular pay day will fall on a national holiday. To avoid penalties Teddy must lodge the superannuation guarantee charge SGC statement within a.

You cant claim a late payment offset for contributions you have used as a prepayment for current or future periods but if you carry a late payment forward it is tax.

6 Knowledge About Late Payment Charges Download Table

Ashburton Courier May 27 2021

Unpaid Super Tally Hits 3 6 Billion Are You Paying Your Employees Superannuation Correctly Smartcompany

G260371kci052 Gif

Late Sg Contribution Tax Deductibility Issue Flagged Smsf Adviser

Late Superannuation Payments Can Be Costly And The Ato Now Has Real Time Access To Your Mistakes Pitcher Partners

What Happens If You Don T Pay Your Super On Time Optimised Accounting Werribee Vic

Super Guarantee Missed Underpaid Or Late Payments

Is It Me Or Are The Proposed Clearer Thinking Regrants From The Open Thread Not Very Good R Slatestarcodex

Late Payment Interest Rate Download Table

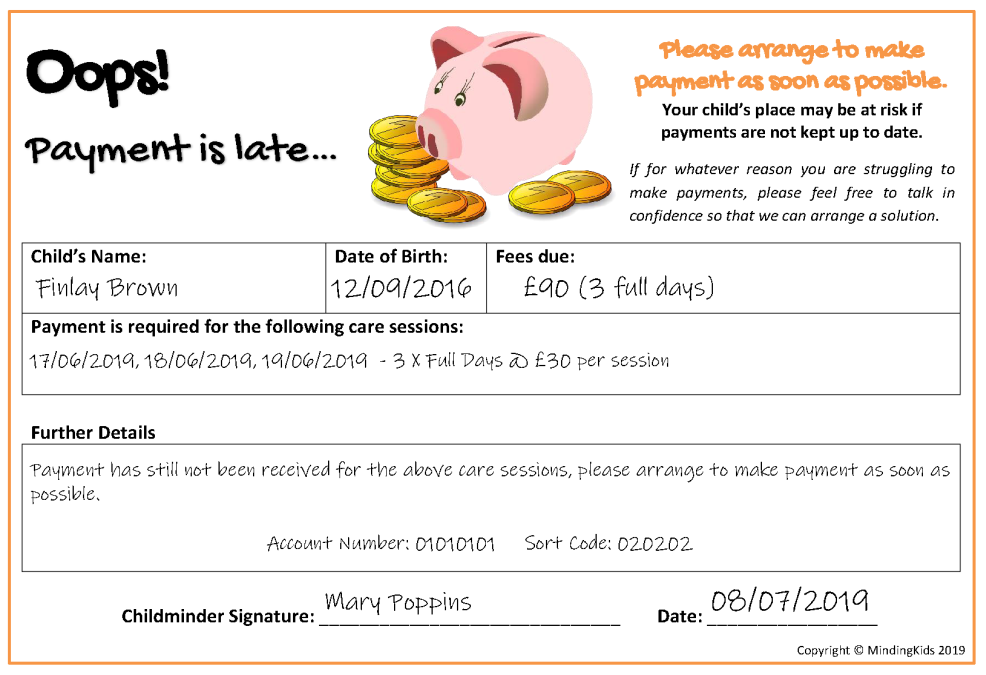

Late Payment Reminder Example Mindingkids

What To Do If You Have Missed A Superannuation Payment For Employees Insights Prosperity Advisers

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1907 Session I Public Accounts Committee Public Service

What To Do If You Have Missed A Superannuation Payment For Employees Insights Prosperity Advisers

What Are The Penalties For Late Super Payments Even If 1 Day Late Youtube

Uk Smes Stretched Further By Late Payments Ctmfile

What Are The Penalties For Late Super Payments Even If 1 Day Late Youtube